Nvidia’s record $57B revenue and upbeat forecast quiets AI bubble talk

Nvidia reports record $57B Q3 revenue and $32B profit, driven by soaring data centre demand, as CEO Jensen Huang dismisses AI bubble concerns.

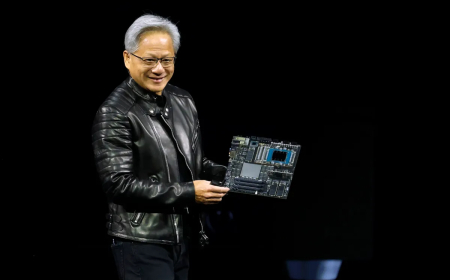

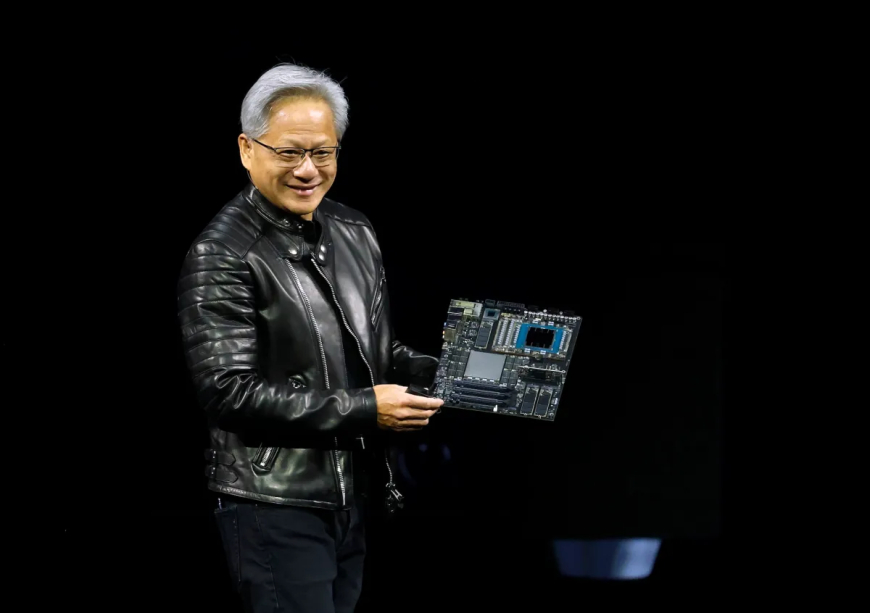

Nvidia founder and CEO Jensen Huang struck an unmistakably optimistic tone during the company’s latest third-quarter earnings — and the numbers appear to justify it.

Nvidia reported $57 billion in revenue for Q3, a 62% increase from the same period last year. GAAP net income reached $32 billion, up 65% year-over-year, surpassing Wall Street expectations across the board.

The company’s explosive growth continues to be driven by its data centre division, which posted a record $51.2 billion in revenue — up 25% from the previous quarter and 66% from last year. Nvidia’s remaining revenue came from its gaming division, which accounted for $4.2 billion, along with contributions from professional visualization and automotive sales.

CFO Colette Kress told shareholders that demand for Nvidia’s datacenter products has been fueled by accelerated computing, increasingly powerful AI models, and a surge in agentic AI applications. On the company’s earnings call, Kress noted that Nvidia announced AI factory and infrastructure projects last quarter, amounting to 5 million GPUs.

“This demand spans every market — CSPs, sovereigns, modern builders, enterprises, and supercomputing centers — and includes multiple landmark build-outs,” Kress said.

The company’s Blackwell Ultra GPU, unveiled in March, has emerged as the top performer across its lineup. Previous generations of Blackwell chips also maintained robust demand.

Huang was even more direct, saying demand for Blackwell is overwhelming:

“Blackwell sales are off the charts, and cloud GPUs are sold out.”

He added that computing needs for both training and inference are growing exponentially:

“We’ve entered the virtuous cycle of AI. The ecosystem is scaling fast — with more foundation model makers, more AI startups, in more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

However, Nvidia acknowledged one central weak spot: China.

Kress said shipments of Nvidia’s H20 data centre GPU, designed for generative AI and high-performance computing, totalled 50 million, which the company considers disappointing. She attributed this to geopolitical restrictions that blocked the chip from being sold in China, combined with rising competition in the region.

“Sizeable purchase orders never materialized due to geopolitical issues and an increasingly competitive market in China,” Kress said. She added that Nvidia remains committed to working with both U.S. and Chinese regulators while advocating for America’s competitiveness in global markets.

Looking ahead, Nvidia expects even more growth, forecasting $65 billion in revenue for its fourth quarter. The upbeat guidance pushed shares more than 4% higher in after-hours trading.

Huang’s message to sceptics was clear: the AI boom is far from over.

“There’s been a lot of talk about an AI bubble,” he said on the earnings call. “From our vantage point, we see something very different.”

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0