Notion Capital Raises $130M Growth Fund to Tackle Europe’s Follow-On Gap

Notion Capital launches a $130M Growth Opps III fund to back European startups in AI, SaaS, and defence tech, addressing the region’s venture capital gap.

The lack of growth capital in Europe is such a persistent issue that some early-stage firms have taken the matter into their own hands. London-headquartered firm Notion Capital is one of them.

In 2017, Notion Capital was one of the first in Europe to close an opportunities fund, providing its portfolio companies with follow-on capital. Now it has closed a $130 million growth fund, nearly twice the size of its previous one, that will also invest outside of its portfolio, TechCrunch learned exclusively.

U.S. VCs that used to fill the growth capital gap currently tend to focus more on their own market, said managing partner Stephen Chandler, noting that “opens up an opportunity for European firms like ourselves to make up some of that difference and be real European champions.”

Some of the European companies Notion intends to “champion” from its new Growth Opps III fund are tied to the growing demand for greater sovereignty, including those specialising in defence and supply chain logistics. But like many, the VC firm is also drawn to AI, which Chandler sees as a super cycle causing “a profound shift in the way that software is delivered and consumed.”

Notion Capital won’t invest in the infrastructure layer, such as large language models. Instead, the firm sees opportunities in the application layer that will “massively increase” the size of its market, Chandler said. While Notion’s flagship fund has historically been known for its strong penchant for SaaS, cloud, and fintech, these will now be AI-infused and joined by new verticals.

The firm expects to make a dozen investments and has already started deploying its capital from the funds. Deals to date include Upvest, a stock trading API from its early-stage portfolio; external companies like Kraken, which manufactures dual-use uncrewed surface vessels; and Nelly, a startup that develops software and financial products for the medical sector, according to Notion Capital.

To give itself some “robust objectivity,” in Chandler’s words, follow-on deals will be conducted by dedicated growth fund partners who will also “go out and source growth stage opportunities outside of the portfolio.”

One of them is existing Notion Capital partner Stephanie Opdam (on the left of the picture). She will now drive this growth strategy alongside Jessica “Jess” Bartos, formerly a principal at Salesforce Ventures. A U.S. national, Bartos is also Notion Capital’s first external partner hire (previous partners were promoted internally).

“Because this was a new strategy, we felt we could benefit from external expertise at that growth stage,” Chandler said.

Subsequent growth funds may also be easier to raise. While Europe has suffered from a lack of pension funds investing in venture capital firms, incentives have started to change in several countries, including France with the Tibi initiative and the U.K. with the Mansion House Accord.

Despite its British roots, Notion Capital isn’t solely dependent on the U.K.’s regulatory framework; this latest Growth Opps III fund is denominated in euros and based in Luxembourg.

To raise this new vehicle, which brings its assets under management to over $1 billion, the firm relied on its existing relationships with limited partners from across continental Europe, the U.K., MENA, and the U.S.

“Something like 85% of our money comes from institutions; and within that, we’re very well geographically dispersed,” Chandler said.

But while recent initiatives to mobilise long-term institutional capital “[weren’t] really a feature in this fund,” he added, “the signs are extremely positive, and that’s great [for] addressing that fundamental problem we started with, in terms of some of the gaps in growth capital we have in Europe.”

“If this finally works out and more LPs participate in growth stage investing, this could translate into more competition for Notion Capital, at least at the growth stage, as it is less established than at the early stage. However, Chandler sees both as a continuum.

“Our real competitive advantage in this growth strategy is leveraging the reach that we have in our early stage strategy,” Chandler said. “Most growth funds don’t have that. They’re out there trying to do all of their sourcing at the growth stage once they put their head above the parapet in terms of scale and momentum.”

In contrast, he said, Notion Capital has many touch points with founders over the years, including through its very active platform team, and is flexible in terms of its check size.

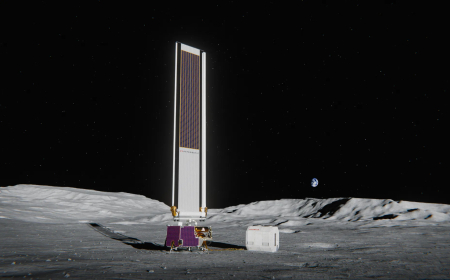

Despite its expanded scope, Growth Opps III’s main asset arguably remains Notion Capital’s portfolio. The firm has invested in more than 150 startups since its inception, including Currencycloud, GoCardless, Mews, Paddle, and Quantum Systems.

While some are pre-AI hype or have been exited, the remaining companies are likely to include future champions. This track record should make external companies more willing to invest in their growth, even if growth capital becomes less scarce in Europe.

This article was updated to reflect which company Notion Capital invested in — it was Kraken Technology, not Octopus Energy spinoff Kraken.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0