SoftBank’s Nvidia sale rattles market, raises questions

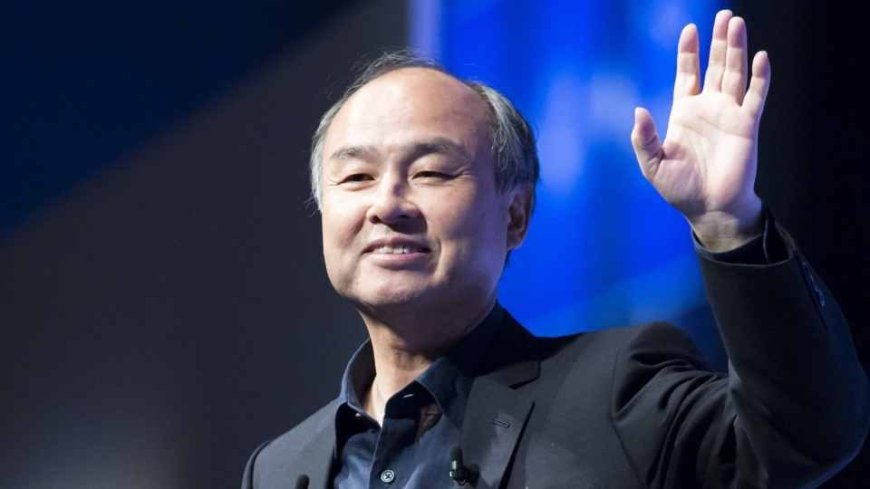

SoftBank founder Masayoshi Son sold his $5.8 billion Nvidia stake to fund major AI investments, including a $30 billion commitment to OpenAI and a $1 trillion AI hub.

SoftBank founder Masayoshi Son has once again gone all-in — this time, by selling his entire $5.8 billion stake in Nvidia to fund what he calls the next great technological leap: artificial intelligence.

The 68-year-old billionaire’s decision, confirmed Tuesday, stunned many across the business world. But for those familiar with Son’s history of bold, all-or-nothing bets, it was classic Masayoshi Son — a man whose career has been defined by moments of spectacular risk and, occasionally, redemption.

From Dot-Com Collapse to Alibaba Windfall

In the late 1990s, Son briefly became the wealthiest person in the world, with a net worth of $78 billion during the height of the dot-com boom. But when the bubble burst in 2000, he lost $70 billion — at the time, the most significant personal financial loss in history — as SoftBank’s market cap plunged 98%, from $180 billion to just $2.5 billion.

Amid that chaos, Son made what would become the most profitable bet of his career: investing $20 million in Alibaba after a six-minute meeting with Jack Ma. That stake eventually grew to $150 billion by 2020, cementing Son’s reputation as one of the most daring investors in modern history.

When Big Bets Go Bad

Yet for every Alibaba, there’s been a WeWork or an Uber. Son’s first Vision Fund, launched in 2017 with $45 billion from Saudi Arabia’s Public Investment Fund, poured billions into high-growth tech startups. But the fund’s biggest bets often backfired.

SoftBank’s investment in Uber generated long-running paper losses, while its $11.5 billion equity stake in WeWork imploded after the company’s failed IPO in 2019. Son famously admitted later that WeWork was “a stain on my life.”

A Full Exit From Nvidia — Again

Tuesday’s revelation marks SoftBank’s second complete exit from Nvidia. The company previously sold a $4 billion stake in 2019 for $3.6 billion — shares that would now be worth over $150 billion.

This time, Son sold all 32.1 million Nvidia shares, worth about $5.8 billion, at roughly $181.58 per share — just 14% below Nvidia’s all-time high. That’s a near-perfect exit for such a massive position, though it briefly sent Nvidia shares down nearly 3% in early trading.

Analysts were quick to clarify that the sale doesn’t signal a loss of confidence in Nvidia, but rather a reallocation of capital toward Son’s new AI ambitions.

SoftBank’s AI Gambit

SoftBank plans to invest $30 billion into OpenAI and participate in a proposed $1 trillion AI manufacturing hub in Arizona, according to reports. The company has also been rapidly expanding its internal AI portfolio through new ventures and partnerships.

For Son, who has called AI “the most important revolution in human history,” this marks yet another high-stakes pivot — one that could define his legacy after decades of spectacular wins and painful losses.

Wall Street Watches Closely

Investors are now asking whether Son sees something others don’t. With SoftBank’s Vision Fund performance improving after a rough few years, the sale could position the company to dominate AI infrastructure and computing just as the global race heats up.

But as history has shown, Son’s approach leaves no middle ground. He either reshapes entire industries — or learns hard lessons at an extraordinary scale.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0