Why the Oracle-OpenAI Deal Caught Wall Street by Surprise

OpenAI and Oracle shocked Wall Street with a $300B deal, boosting Oracle’s stock. Here’s why the agreement matters for AI infrastructure and future power needs.

This week, Oracle and OpenAI jolted markets with the announcement of a surprise $300 billion, five-year partnership, sparking a surge in Oracle’s stock price. While the deal stunned many on Wall Street, perhaps it shouldn’t have. The agreement underscores that Oracle, despite its reputation as a legacy player, continues to hold weight in the AI infrastructure space.

For OpenAI, the deal reveals more than the sparse details suggest. The startup’s willingness to commit such a massive amount to compute resources highlights its insatiable demand for processing power — even if questions linger about how it will cover the bill or where the electricity needed to run those systems will come from.

Chirag Dekate, vice president at Gartner, explained to TechCrunch why both sides pursued the agreement. For OpenAI, working with multiple infrastructure providers makes sense, offering both diversification of risk and a scaling edge over rivals.

“OpenAI seems to be assembling one of the most comprehensive global AI supercomputing foundations for extreme scale, inference scaling where appropriate,” Dekate said. “This is unique. It’s probably the clearest example of what a model ecosystem should look like.”

Some industry watchers were taken aback by Oracle’s inclusion, given its lower profile in the current AI boom compared to Microsoft Azure, Google Cloud, or AWS. But Dekate stressed this shouldn’t be surprising: Oracle has collaborated with hyperscalers before and powers major operations such as TikTok’s U.S. infrastructure.

“Over decades, they built core infrastructure capabilities that allow them to deliver extreme scale and performance at the heart of their cloud services,” Dekate noted.

Power and payment questions

Despite the stock market’s enthusiastic response, critical details remain unclear — particularly around costs and energy supply.

Over the past year, OpenAI has announced several big-ticket infrastructure investments. These include roughly $60 billion annually with Oracle for compute and $10 billion with Broadcom for custom AI chip development.

At the same time, OpenAI disclosed in June that it had reached $10 billion in annual recurring revenue, up from $5.5 billion a year earlier. This includes income from ChatGPT subscriptions, enterprise products, and its API. While CEO Sam Altman remains optimistic about future growth, the company continues to burn through billions in cash.

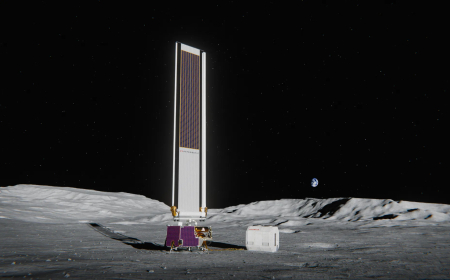

The energy question looms large. Analysts point to natural gas as a near-term power solution, while solar and battery storage may offer more cost-effective supply in certain markets. Other tech companies are also wagering heavily on nuclear energy.

The demand isn’t entirely unexpected: a Rhodium Group report released this week projects that U.S. data centers will consume 14% of the nation’s electricity by 2040.

Hardware scarcity has already driven investors to stockpile GPUs. Andreessen Horowitz reportedly acquired more than 20,000 Nvidia chips, while Nat Friedman and Daniel Gross rented a 4,000-GPU cluster — potentially now under Meta’s ownership. Yet compute is meaningless without power. To ensure consistent supply, tech giants are buying solar farms, acquiring nuclear facilities, and signing geothermal deals.

So far, OpenAI has remained relatively quiet on energy investments. While Sam Altman has personally backed ventures like Oklo, Helion, and Exowatt, the company itself hasn’t invested as aggressively as Amazon, Google, or Meta.

With this 4.5 gigawatt compute commitment, that may soon change. OpenAI could take an indirect role, with Oracle managing the heavy infrastructure while Altman continues channeling capital into energy startups aligned with OpenAI’s future needs. Such an arrangement would keep OpenAI “asset-light” — appealing to investors and ensuring the company retains the valuation profile of a software-first AI firm rather than a hardware-heavy legacy provider.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0