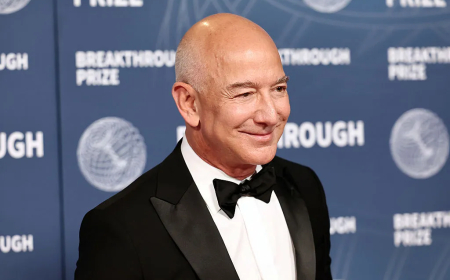

Major Tesla Investor Rejects Elon Musk's $1 Trillion Pay Deal

Norway’s $1.6 trillion sovereign wealth fund voted against Tesla’s $1 trillion pay package for Elon Musk, citing concerns over dilution and key person risk.

Norway’s sovereign wealth fund, one of the world’s largest institutional investors, has voted against Tesla’s proposed $1 trillion compensation package for CEO Elon Musk, marking another setback in his ongoing effort to secure shareholder approval for what would be the biggest corporate pay deal in history.

The fund, managed by Norges Bank Investment Management (NBIM), owns approximately 1.14% of Tesla, valued at roughly $11.7 billion as of the mid-year filings in June.

In a statement posted to its website, NBIM said:

“While we appreciate the significant value created under Mr. Musk’s visionary role, we are concerned about the total size of the award, dilution, and lack of mitigation of key person risk — consistent with our views on executive compensation.”

NBIM added that it intends to continue constructive dialogue with Tesla on the issue, suggesting that the vote reflects governance concerns rather than opposition to Musk’s leadership itself.

A Growing List of Dissenters

Norway’s decision follows recommendations from influential proxy advisory firms ISS and Glass Lewis, which also urged shareholders to vote against the proposed pay package.

The plan, which could be worth up to $1 trillion, was initially approved by shareholders in 2018 but later struck down by a Delaware court earlier this year, ruling it “excessive.” Tesla is now seeking shareholder approval in a renewed vote.

Despite mounting opposition, Musk maintains that the package is less about financial reward and more about ensuring his control over Tesla’s long-term direction.

During Tesla’s third-quarter earnings call, Musk reiterated that position, suggesting that without the compensation structure in place, he might shift his focus to other ventures.

“It’s not about the money,” Musk said. “It’s about the influence required to steer the company into the future.”

What’s at Stake

The vote carries significant implications not only for Musk’s leadership at Tesla but also for corporate governance standards in the broader tech and automotive sectors.

NBIM’s opposition underscores growing institutional scepticism regarding mega-pay packages, especially when tied to charismatic founders whose companies heavily depend on their continued involvement — a dynamic often described as “key person risk.”

Even if Tesla wins the shareholder vote, the controversy highlights ongoing tension between Musk’s visionary role and shareholder expectations for accountability and dilution control.

For now, the Norwegian wealth fund’s decision adds another high-profile “no” vote to a list that continues to grow — leaving the fate of Musk’s trillion-dollar payday uncertain.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0