Danish startup Flatpay joins the club of European fintech unicorns

Danish startup Flatpay reaches a €1.5B valuation and unicorn status as it rapidly scales to 60,000 SMB customers and €100M ARR. The company raises €145M to expand across Europe.

Flatpay, a fast-growing Danish fintech that provides card payment solutions for small and medium-sized businesses, has officially entered Europe’s unicorn club — crossing a valuation of more than $1 billion. This places the three-year-old startup alongside some of Europe’s biggest fintech success stories, including Dutch payments giant Adyen.

Flatpay’s strategy is simple yet powerful: it offers small merchants a flat transaction rate for using its card terminals and POS systems. That model has resonated across Europe’s SMB sector, which represents 99% of all businesses across the continent. As a result, the company has scaled at a remarkable speed, growing from 7,000 customers in April 2024 to nearly 60,000 today.

Flatpay’s valuation has climbed just as quickly. Now valued at €1.5 billion ($1.75 billion), the company reached unicorn status in under three years. But co-founder and CEO Sander Janca-Jensen says the milestone he is most focused on is annual recurring revenue.

“We crossed €100 million in ARR in October,” Janca-Jensen told TechCrunch, adding that this figure — roughly $116 million — is increasing by close to €1 million every day. “The plan for 2026 is to grow another 300%, so hopefully end the year between €400 million and €500 million in ARR.”

To fuel this aggressive growth target, Flatpay has raised €145 million (~$169 million) in fresh funding. The round was backed by AVP, Smash Capital, and Dawn Capital, which had also led the company’s previous $47 million Series B. Football star Mario Götze took part in that earlier round as well.

The new capital will support expansion in Flatpay’s existing markets — Denmark, Finland, France, Germany, Italy, and the U.K. — while also enabling entry into one or two new countries in 2025. Although the CEO did not reveal where those markets will be, recent job postings suggest the Netherlands may be next.

The company currently employs around 1,500 people — known internally as “flatpayers” — and plans to double its workforce by the end of next year. Flatpay has adopted a unique approach to customer acquisition: its sales teams visit SMB owners in person, explaining pricing on paper and demonstrating the terminals on the spot.

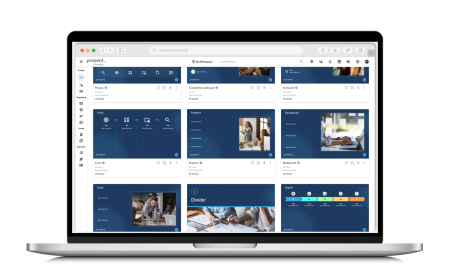

Flatpay’s demo kit Image Credits:Flatpay

This direct, hands-on model results in higher acquisition costs, especially when combined with 24/7 customer support; however, Flatpay argues that it produces stronger long-term loyalty and accelerates growth. Investors appear to agree, especially given the company’s triple-digit revenue expansion and massive SMB market.

The fintech company is also exploring new product lines. While AI isn’t its core focus, Flatpay is experimenting with voice-based AI agents and plans to roll out a broader banking suite, including cards and business accounts, in the future.

For now, the mission remains clear: to help Europe’s small businesses adopt simple, transparent, and reliable payment solutions that are free from complexity and hidden fees. As Janca-Jensen put it, SMB owners should be able to “eat the elephant one bite at a time.”

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0