Flipkart’s Super.money Quietly Partners with Troubled Juspay as It Expands Its Reach

Super. Money, Flipkart’s financial service platform, has partnered with Juspay to expand into direct-to-consumer (D2C) checkout. This strategic collaboration helps Super. Money builds its presence in the e-commerce ecosystem while Juspay seeks to recover from setbacks in India’s competitive payments landscape.

Super. Money, the financial service platform spun off by Walmart-owned Flipkart last year, has quietly partnered with Juspay, a payments infrastructure firm, as it expands into direct-to-consumer (D2C) checkout. The platform aims to achieve $100 million in annual revenue by 2026.

The partnership comes at a time when Juspay is working to rebuild momentum after facing significant pushback from major payment companies earlier this year, which complicated its fundraising efforts.

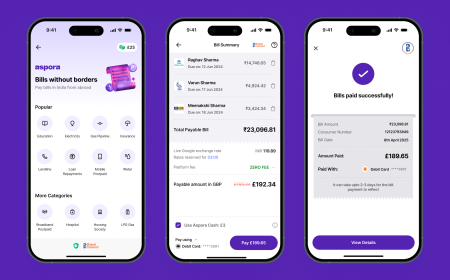

New Product Launch: Super.money Breeze

Last week, SuperMoney launched its D2C checkout product, Super. Money Breeze, which promises one-click checkout to speed up online purchases by eliminating one-time passwords and repeated logins. The company didn’t initially disclose any technology partners, but TechCrunch has confirmed that Juspay is powering the payments infrastructure behind the Breeze product.

This partnership could help Super. Money is tapping into new customers and increasing visibility among D2C, enabling it to expand its presence beyond Flipkart’s existing user base. The checkout product signals an effort to carve out a stand-alone identity in the broader e-commerce ecosystem, despite already benefiting from Flipkart’s vast distribution network.

Juspay’s Struggles and the Changing Payments Landscape

For Juspay, the partnership is especially significant as it seeks to regain ground after losing several key merchants earlier this year. In January, Razorpay and Cashfree Payments—two major payment gateways—moved away from Juspay, urging merchants to adopt their in-house payment tools instead. This setback affected Juspay’s fundraising, with its latest round coming in at $60 million, well below the expected $100 million.

Juspay, once a go-to back-end partner for payment aggregators, has faced increasing competition in India’s digital payments space, with players like Razorpay, Cashfree, and Flipkart spinoff PhonePe opting to deepen their direct relationships with merchants. Despite these challenges, Juspay continues to collaborate with major players like Amazon, and the partnership with SuperMoney represents a potential rebound.

Super.money’s Growing Reach

Super. Money, which launched as a payment app in June 2024, has already made significant strides in the Indian payments market. In just over a year, it has become one of India’s top five UPI (Unified Payments Interface) apps by transaction volume. In August, the app processed over 200 million transactions per month for four consecutive months, according to data from the National Payments Corporation of India (NPCI).

Moreover, Super. Money has surpassed prominent players like Axis Bank, ICICI Bank, Amazon Pay, and CRED in the UPI rankings—a remarkable achievement for a new app. The platform has also become a leading issuer of secured credit cards in India, with a 10% market share, according to industry data.

Super. money’sMonetisationn Strategy

Super. Money plans to expand its business by focusing on its secured credit card and personal lending products. The company currently issues 300,000 secured cards, adding approximately 50,000 new cards each month. These secured cards, which require a customer deposit, are issued in partnership with Utkarsh Small Finance Bank. Super. Moneyy is in talks with a private-sector lender to further scale distribution.

The company also benefits from Flipkart’s distribution network and operates with a lean team of around 130-150 people. However, it does not charge for UPI transactions. Money uses this volume to onboard customers and cross-sell higher-margin offerings such as credit cards and consumer loans.

Future Plans and Competition

Super. moneaims to reach $30 million in annual recurring revenue by the end of 2025, with plans to triple that figure by 2026. The growth will largely come from the secured credit card business, personal lending, and the newly launched D2C checkout product. However, as the company scales, it will face increasing competition from established players such as PhonePe, Google Pay, and Razorpay, all of which are building or enhancing their own payment infrastructures.

For Super. Money, the ability to convert its UPI scale into sustainable revenue, particularly through lending and checkout solutions, will determine whether it becomes Flipkart’s second major fintech success or faces growing challenges as competition intensifies.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0