Sequoia-backed fintech Aspora will let Indian diaspora pay bills back home

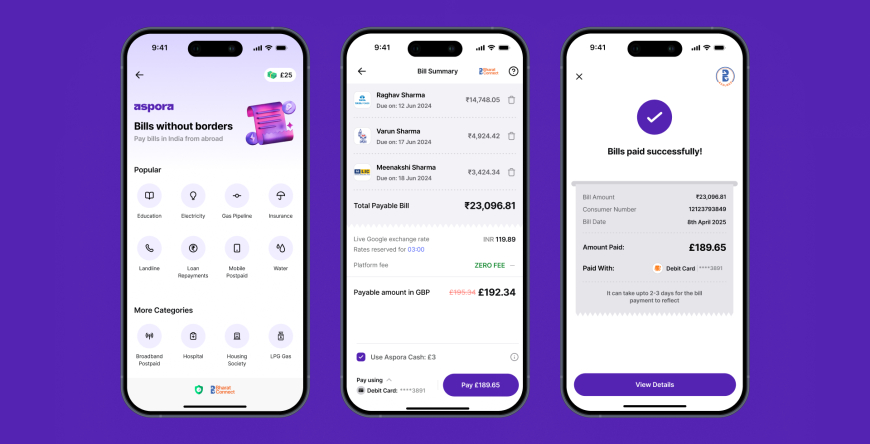

Aspora now allows NRIs to pay Indian bills directly through BBPS, covering over 22,000 billers. No fees, best exchange rates, and seamless cross-border payments.

Sequoia-backed fintech platform Aspora, which enables the Indian diaspora to send money back to India, is rolling out a new bill payment feature that allows non-resident Indians (NRIs) to directly pay utility bills and recharge mobile plans for their families back home.

Until now, most NRIs had to transfer money to their bank accounts in India or rely on relatives to settle these payments. The alternative — using foreign cards directly on Indian platforms — often led to high fees, failed transactions, and added friction.

Aspora has now integrated with the Bharat Bill Payment System (BBPS) via Yes Bank, unlocking access to more than 22,000 billers across India. This includes electricity boards like BSES and BESCOM, broadband providers such as Jio and Airtel, as well as loan payments for major banks.

The company states that it will not charge any fees for these bill payments, and users will receive competitive exchange rates when paying bills directly in the foreign currency.

“For millions of Indians living overseas, paying bills in India has always been unnecessarily complex — involving transfers, delays, and double fees. Aspora has now solved this large-scale problem at the tap of a button,” Aspora founder and CEO Parth Garg said in a phone interview.

Garg noted that bill payments might marginally reduce overall remittance volume — roughly by 4% to 5% — but the added convenience increases long-term engagement on the platform.

“Today, the goal for any neo bank is to get more transactions on your app. With remittances, people were using the app once or twice a month. With this new bill payment feature, velocity increases and users return more frequently,” he added.

Aspora has already tested the feature with a few thousand users over several weeks, where mobile recharges emerged as one of the strongest use cases. Since BBPS doesn’t support mobile recharges or credit card payments for foreign payers, Aspora partnered with global mobile recharge company Ding to enable these transactions.

The bill payment feature is currently live for users in the U.K., with plans to expand soon to the U.S. and the UAE.

In June, Aspora raised $50 million in Series B funding at a $500 million valuation, led by Sequoia, with participation from Greylock, Hummingbird, Quantum Light Ventures, and Y Combinator. The fintech has raised over $99 million to date and expanded its services to NRIs in the U.S. in July — the largest source of remittances into India, accounting for nearly 28% of the total, according to the Reserve Bank of India.

Aspora now has 800,000 customers, has processed $4 billion worth of transactions, and claims to have saved users $25 million in transfer fees.

Looking ahead, Aspora plans to introduce NRE (Non-Resident External) accounts for managing foreign income and NRO (Non-Resident Ordinary) accounts for managing income earned in India, with a targeted launch next year.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0