Groww, Backed by Satya Nadella, Set to Become First Indian Startup to Go Public After U.S.-to-India Move

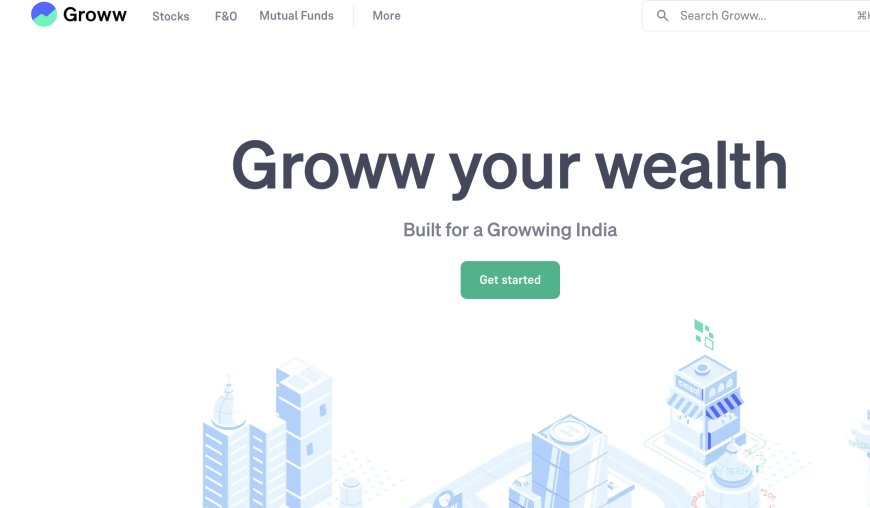

Groww, India’s largest retail brokerage, is set to become the first Indian startup to go public after relocating its headquarters from the U.S. to India. The company’s IPO aims to raise millions, with backing from investors including Satya Nadella.

Groww, India’s largest retail brokerage firm, is preparing to test the country’s public markets with a multi-billion-dollar IPO. This listing follows the company’s decision to relocate its corporate headquarters from Delaware to India, which was made just over a year ago. The move could make Groww the first Indian startup to list at home after shifting its base from the U.S..

Backed by Microsoft CEO Satya Nadella and prominent investors such as Peak XV Partners, Y Combinator, Ribbit Capital, and Tiger Global, Groww’s IPO — expected later this year — is also set to serve as a significant exit opportunity for global venture funds. According to the draft IPO documents filed on Tuesday, the four investment firms are selling approximately 394 million shares, or 9.4% of Groww’s total equity. These shares represent about 69% of all the shares being offered to the public.

Other Indian startups, including Pine Labs, Razorpay, Meesho, and Zepto, have also recently moved their headquarters back to India. Notably, Walmart-backed PhonePe relocated its headquarters from Singapore to India in 2022, while Flipkart, once PhonePe’s parent company and also backed by Walmart, announced similar plans to shift its base back to India earlier this year.

In 2022, Groww became one of the first startups to move its headquarters from the U.S. to India, paying around $159 million in taxes as part of the relocation process.

By moving their base back to India, startups can align with evolving local regulations and meet the requirements for listing in India’s public markets. The move is especially timely given the growing retail investor base and increasing demand for IPOs in the country. This trend highlights the rising maturity and appeal of India’s capital markets compared to other global alternatives.

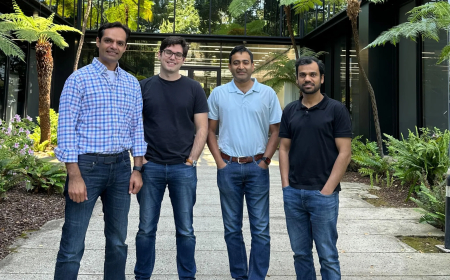

While U.S. investors plan to offload a substantial portion of their holdings, Groww’s founders — Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal — will be selling only about 4 million shares, or 0.7% of the total offer for sale. This indicates that the founders are holding on to nearly all of their equity, while established investors are using the IPO as an exit strategy.

Groww aims to raise ₹10.6 billion (around $121 million) in new funding through the IPO, alongside a secondary sale of 574 million shares by existing shareholders, which is expected to raise between ₹5–6 billion (roughly $568–$682 million). The IPO is expected to value the Bengaluru-based company at $9 billion.

For the fiscal year ending March 31, Groww reported a total income of ₹40.6 billion (about $462 million), marking a 45% year-on-year growth, with a profit after tax of ₹18.2 billion (approximately $208 million). This performance contrasts with the company’s net loss of ₹8 billion (around $92 million) in the previous year, which was primarily due to expenses related to the relocation of its headquarters.

As of June, Groww had around 37.4 million individual demat accounts (digital accounts holding securities), representing nearly 19% of India’s market, and 12.6 million active clients on the National Stock Exchange, which accounts for 26% of the market share. The platform also reported about 17 million active systematic investment plans (SIPs) and 9 million unique mutual fund investors, making Groww the only investment app in India to surpass 100 million cumulative downloads.

JPMorgan Chase, Kotak Mahindra Bank, Citigroup, Axis Bank, and Motilal Oswal Investment Advisors are advising the offering.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0