Pine Labs Gets Warm Market Welcome on $440M India IPO Despite Valuation Trim

Pine Labs’ $440M IPO closed 14% higher despite a valuation cut, signalling investor confidence in India’s growing fintech expansion globally.

Payment technology company Pine Labs, backed by PayPal and Mastercard, made a strong public debut on Friday, ending its first day of trading 14% higher even after slashing its valuation for its $440 million IPO. The listing marks the second-largest fintech IPO in India this year, following online brokerage Groww’s $750 million debut earlier this week.

Pine Labs’ stock opened at ₹242, climbed to ₹284, and finally settled at ₹252, up from its issue price of ₹221. This closing price gives the Gurugram-based company a market capitalisation of ₹289 billion (around $3.3 billion).

Though lower than its 2022 private valuation of over $5 billion, the outcome underscores investor confidence in India’s push to expand its fintech footprint globally.

A Global Expansion Story

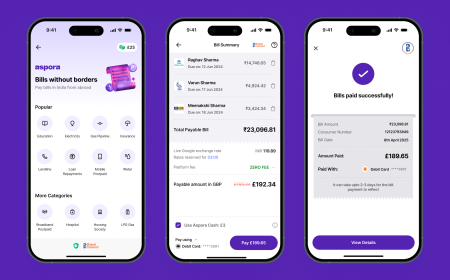

Founded in 1998, Pine Labs started as a point-of-sale terminal provider and has since evolved into a comprehensive payments platform, offering bill payments, account aggregator transactions, and a suite of merchant and acquiring services.

The company now operates in 20 international markets, including Malaysia, Singapore, Australia, the UAE, the U.S., and regions across Africa. In India, it competes with Razorpay, Paytm, and Walmart-owned PhonePe.

Financially, Pine Labs turned profitable in the June quarter, posting a net profit of ₹47.86 million ($540,000) compared with a loss of ₹278.89 million a year earlier. Revenue from operations rose 17.9% year-over-year to ₹6.16 billion ($69 million), with its overseas business contributing about 15% of total revenue, up to ₹943.25 million ($11 million) from ₹795.97 million a year prior.

“We will never stop being a startup,”

said Amrish Rau, CEO of Pine Labs, during the listing ceremony.

“Now that we are a listed company, [that word] will not be heard in our halls.”

Investor Confidence and Backstory

Among those selling part of their holdings during the public listing were Peak XV Partners, Temasek Holdings, PayPal, and Mastercard.

“Pine Labs never wanted to compete on price,”

said Shailendra Singh, Managing Director at Peak XV Partners.

“It always wanted to compete on a superior proposition. We know this company will continue compounding because of its strong moats. It shaped how we think about patient investing and letting ecosystems mature.”

Peak XV Partners, which separated from Sequoia Capital in 2023, first invested in Pine Labs back in 2009, during the global financial crisis. This week marks the firm’s second major public exit, coming just days after Groww’s IPO, which debuted with a 12% jump and closed the day 29% above its issue price of ₹100.

IPO Momentum in India

Pine Labs’ debut comes amid a surge in India’s IPO market, as startups across tech, fintech, e-commerce, and manufacturing tap into strong domestic investor appetite. Favourable interest-rate conditions and regulatory support have further accelerated the listing process.

Globally, finance has been the top IPO sector of 2025, with total offerings reaching $34.34 billion, more than double the $14.05 billion raised over the same period in 2024, according to Dealogic.

What’s Next for Pine Labs

With its public listing complete, Pine Labs plans to broaden its global reach while strengthening its presence in India through new products and digital payment services tailored to the nation’s expanding online consumer base.

“Our core business will keep expanding. Our moats will be strengthened, and margins will grow,”

said Rau.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0