Complyance raises $20M to help companies manage risk and compliance

Complyance has raised $20 million to expand its risk and compliance platform, aiming to help businesses streamline governance, regulatory reporting, and operational oversight.

Richa Kaul describes herself as someone deeply passionate about data privacy. In social settings, she often advises friends on tightening their smartphone privacy settings. Over time, she realised that protecting individual consumers at scale required a broader approach. “It got to a point where I realised the best way actually to protect consumer data is to help secure the enterprises that hold the world’s data,” she explained.

That realisation led her to found Complyance, a company focused on helping enterprises better manage governance, risk, and Compliance. On Wednesday, Compliance announced that it has secured $20 million in Series A funding, led by GV.

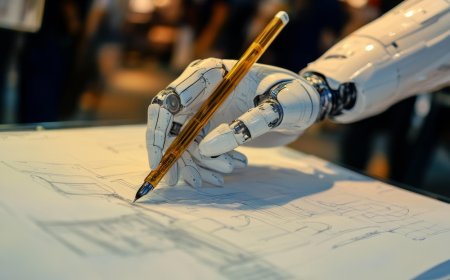

Compliance operates as an application that integrates directly into a company’s existing technology infrastructure. The platform deploys AI agents to help organisations oversee governance, risk management, and data compliance processes. According to Kaul, the system automates many of the manual workflows that typically consume significant time and resources.

“The AI basically automates several manual tasks,” Kaul said. “It uses AI to do custom checks on data coming in against their own specific criteria and risk thresholds.” Once the system identifies potential issues, it flags them for further review.

Traditionally, risk assessments and compliance audits can take weeks or even months to complete when handled manually. These audits often follow a periodic schedule—perhaps quarterly or annually—during which teams conduct organisation-wide reviews. Tools like Compliance aim to streamline and modernise the model by running continuous checks in real time, reducing the need for lengthy review cycles and helping companies maintain ongoing compliance visibility. The platform also includes an AI agent that evaluates the risk exposure associated with third-party vendors.

Kaul says the broader mission is to transform how governance, risk, and compliance (GRC) teams allocate their time and energy. “We’re trying to redefine what enterprise GRC teams spend their time doing right now,” she said, noting that many professionals in the space are burdened with repetitive and administrative tasks. By automating those responsibilities, Complyance hopes to enable teams to focus on higher-level strategy and oversight.

The company operates in a competitive landscape that includes established players such as Archer, ServiceNow (via its GRC solutions), and OneTrust. Kaul argues that Compliance stands apart because it was built as an AI-native platform from the ground up, rather than adding artificial intelligence features onto an existing legacy framework.

While Kaul declined to disclose the exact number of customers currently using the platform, she indicated that Complyance is already working with several Fortune 500 companies. In total, the startup has raised $28 million in funding to date. Although it emerged from stealth in 2023, its first product did not officially reach the market until late 2024.

Kaul described the fundraising process as unusually smooth, noting that GV initiated the conversation. “They’ve been looking for an enterprise-grade AI-led product in the space that was winning over enterprise clients, and we were doing that,” she said. In addition to GV, participants in the Series A round included Speedinvest, Everywhere Ventures, and angel investors affiliated with Anthropic and Mastercard.

The newly secured capital will support Compliance’s go-to-market expansion efforts. Kaul also plans to significantly broaden the platform’s capabilities by introducing 30 additional purpose-built AI agents, building on the 16 already included in the product.

Ultimately, the company’s objective is to simplify and elevate the work of governance, risk, and compliance professionals. “They didn’t sign up to chase down mundane tasks,” Kaul said. “They signed up to help protect their businesses and help protect their business customers.” By reimagining workflows and redefining how compliance operations are executed, Complyance aims to empower GRC teams to focus on strategic priorities rather than repetitive administrative tasks.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0