Fintech CEO and Forbes 30 Under 30 alum has been charged for alleged fraud

A fintech CEO who was previously named to Forbes’ 30 Under 30 list has been charged with alleged fraud, raising new questions about oversight in the startup sector.

By now, the Forbes 30 Under 30 list has developed a reputation for controversy, mainly because of the number of alumni who later faced fraud charges. High-profile examples include former FTX founder Sam Bankman-Fried, Frank CEO Charlie Javice, Joanna SmSmith-Gryphonf AI startup AllHere Education, and Martin Shkreli, often referred to as “pharma bro.” Now, another member of the prestigious list has been charged by federal authorities.

Gökçe Güven, a 26-year-old Turkish national and the founder and CEO of fintech startup Kalder, was charged last week with alleged securities fraud, wire fraud, visa fraud, and aggravated identity theft.

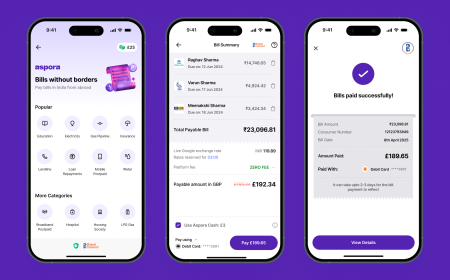

The New York–based fintech company, which uses the tagline “Turn Your Rewards into [a] Revenue Engine,” claims to help businesses design and monetise individual customer rewards programs. Founded in 2022, Kalder enables companies to generate recurring revenue through affiliate sales, according to earlier reporting by Axios.

Güven appeared on last year’s Forbes 30 Under 30 list. In its profile, Forbes noted that Kalder’s clients included luxury chocolatier Godiva and the International Air Transport Association, which represents most of the world’s airlines. Kalder has also claimed backing from several well-known venture capital firms.

According to allegations from the U.S. Department of Justice, Güven raised $7 million from more than a dozen investors during Kalder’s seed funding round in April 2024. Prosecutors allege that the funds were secured through a deck containing false and misleading information.

Federal authorities say the pitch materials claimed that 26 brands were actively “using Kalder,” and another 53 were categorised as “live freemium” users. In reality, prosecutors allege that many of those companies were only offered deeply discounted pilot programs. Other brands listed in the materials “had no agreement with Kalder whatsoever — not even for free services,” according to a DOJ press release announcing the indictment. The pitch deck also allegedly misrepresented Kalder’s financial performance, claiming that recurring revenue had grown steadily month over month since February 2023 and that the company had reached $1.2 million in annual recurring revenue by March 2024.

The government further alleges that Güven maintained two separate sets of financial records. One set reportedly included “false and inflated numbers” and was presented to investors or prospective investors to conceal the company’s actual financial condition, as prosecutors describe.

In addition, the DOJ claims that Güven used false statements about Kalder’s business operations, along with forged documents, to secure a visa category reserved for individuals of “extraordinary ability,” which would allow her to live and work legally in the United States.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0