Twilio co-founder’s fusion power startup raises $450M from Bessemer and Alphabet’s GV

Fusion power startup founded by a Twilio co-founder secures $450 million in funding from Bessemer Venture Partners and Alphabet’s GV to accelerate commercial clean energy development.

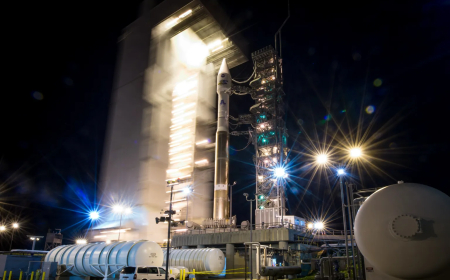

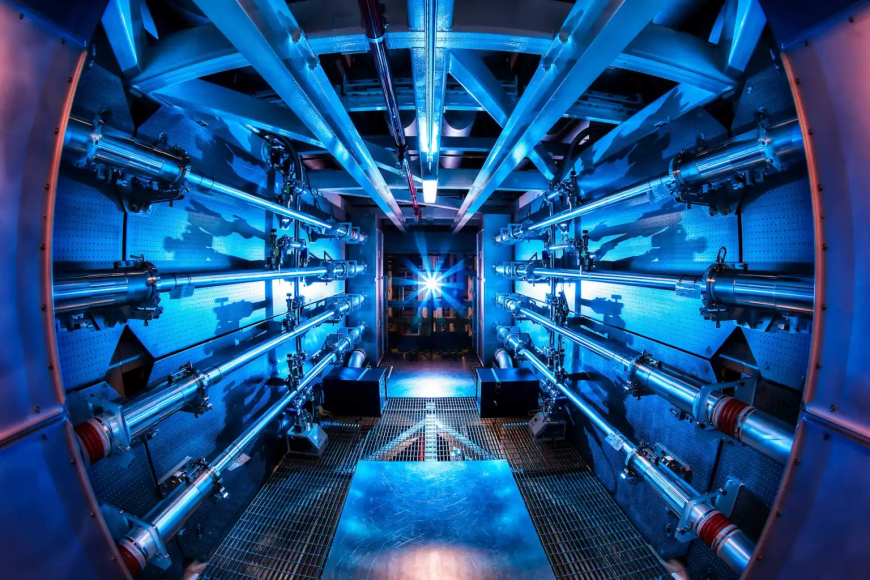

Inertia Enterprises has secured $450 million in new funding to support its effort to construct one of the most powerful laser systems in the world, a critical step toward developing a grid-scale fusion power plant that the company aims to begin building in 2030. The startup is leveraging technology pioneered at the Lawrence Livermore National Laboratory’s National Ignition Facility (NIF), the only site to date where controlled fusion reactions have achieved scientific breakeven. Scientific breakeven occurs when a fusion reaction releases more energy than was required to initiate it.

The Series A round was led by Bessemer Venture Partners, with participation from GV (the investment arm of Alphabet), Modern Capital, Threshold Ventures, and other investors.

Inertia Enterprises was co-founded by Jeff Lawson, co-founder and CEO of Twilio; Annie Kritcher, who led the landmark breakeven experiments at NIF; and Mike Dunne, a Stanford professor who collaborated with Lawrence Livermore on designing a power plant concept based on NIF’s research. Kritcher continues to hold her position at Lawrence Livermore while contributing to Inertia’s efforts.

The breakeven milestone achieved at NIF marked a major scientific breakthrough for fusion energy. However, significant engineering and scaling challenges remain before fusion can reliably supply electricity to the grid. For Inertia, a central objective is to develop a laser system capable of delivering 10 kilojoules of energy 10 times per second, a substantial leap in repetition rate and efficiency compared with existing experimental setups.

The company’s reactor concept is based on inertial confinement fusion. In this approach, powerful lasers strike a small fuel target, compressing it to extreme densities and temperatures until atomic nuclei fuse, releasing energy. Inertia’s design builds on NIF’s method, where laser light is first converted into X-rays within the target chamber. These X-rays then uniformly heat and compress the fuel pellet, triggering the fusion reaction.

Each planned Inertia power plant will require approximately 1,000 lasers firing at 44.5-millimetrefuel targets. The company intends to mass-produce these targets at a cost of less than $1 per unit. By comparison, NIF’s system employs 192 lasers aimed at highly specialised targets that require dozens of hours to manufacture. Inertia is betting that by adapting NIF’s scientific principles while applying a commercial production model, it can drastically reduce costs and move fusion closer to practical deployment.

The company’s latest funding round adds to a broader surge of investment in fusion energy startups. With this raise and other recent financings, fusion companies have collectively attracted more than $10 billion in capital. At least a dozen firms in the sector have now raised over $100 million each, underscoring the growing confidence in fusion as a long-term clean energy solution.

In recent weeks, Avalanche Energy announced it had secured $29 million to advance its compact, desktop-scale fusion reactor. Earlier this year, Type One Energy disclosed that it had raised $87 million ahead of an ongoing $250 million Series B round. Last summer, Commonwealth Fusion Systems brought in $863 million from a wide range of investors, including Google, Nvidia, and Breakthrough Energy Ventures.

Additionally, two fusion companies have recently announced plans to go public through reverse mergers. General Fusion revealed in January that it would merge with acquisition vehicle Spring Valley Acquisition Corp. III in a deal valuing the combined entity at $1 billion. General Fusion had previously faced challenges securing sufficient private investment.

More recently, TAE Technologies announced plans to merge with Trump Media & Technology Group in an all-stock transaction valued at approximately $6 billion.

As investment continues to pour into the fusion sector, Inertia Enterprises is positioning itself among the most well-capitalised players pursuing grid-scale fusion power. By building on the scientific foundation established at the National Ignition Facility and focusing on commercial scalability, the company aims to translate laboratory success into a practical energy source that delivers clean electricity at a meaningful scale in the coming decade.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0