Lidar-maker Ouster buys vision company StereoLabs as sensor consolidation continues

Lidar manufacturer Ouster acquires vision firm StereoLabs, expanding its 3D perception portfolio as consolidation accelerates across the autonomous sensor market.

Ouster, a developer of lidar sensing technology, has finalised its acquisition of StereoLabs, a firm recognised for its vision-driven perception systems used across robotics and industrial sectors. The agreement consists of $35 million in cash alongside 1.8 million shares.

This transaction marks another milestone in the continuing consolidation of perception sensor providers. Recently, MicroVision acquired Luminar's lidar assets for $33 million after Luminar, once considered a high-profile player in the field, filed for bankruptcy. Ouster has also been active in strategic acquisitions. In 2022, it merged with competitor Velodyne, and in 2021, it purchased lidar startup Sense Photonics.

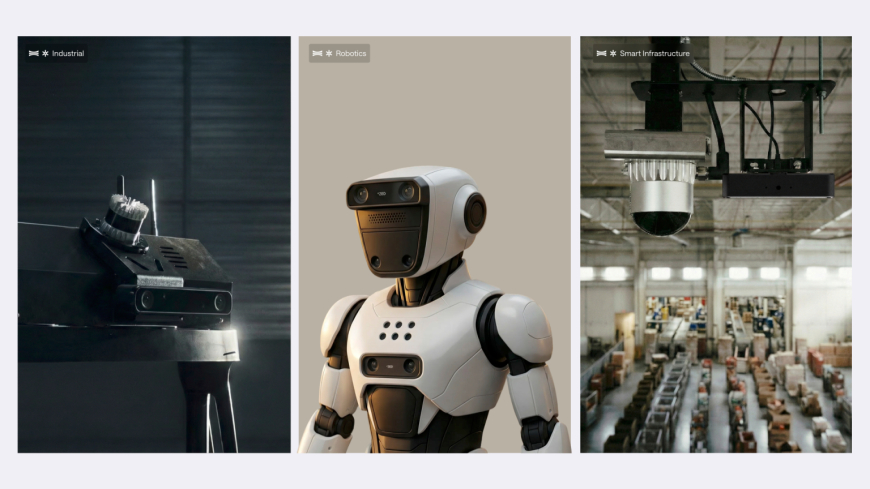

The acceleration of consolidation is unfolding at a time when companies and investors are heavily focused on advancing what is often described as "physical AI." This expansive category includes technologies such as humanoid robotics, drones, autonomous vehicles, and warehouse automation systems. As these areas progress, even smaller, specialised suppliers are securing large funding rounds. Some startups are pursuing entirely new sensing approaches, aiming to introduce novel modalities into the competitive landscape.

Angus Pacala, co-founder and CEO of Ouster, said in an interview that StereoLabs had long been a company of interest. He explained that lidar is a foundational component of safety-critical, high-performance systems, but emphasised his desire to extend Ouster's capabilities further up the perception technology stack.

Pacala identified cameras as the most natural complement to lidar technology. He described StereoLabs, which has been operating for approximately 15 years, as a leader in hardware design. However, what stood out most was the company's ability to integrate artificial intelligence and edge computing to optimise the output and intelligence of its camera systems.

He specifically highlighted StereoLabs' development of a foundational AI model that estimates depth from stereo camera configurations. This advancement, Pacala noted, enhances perception capabilities by integrating computer vision with real-time analytics, thereby strengthening the overall sensing ecosystem.

Pacala characterised the acquisition as a strategic decision, noting that it offered a logical opportunity to collaborate on developing a unified sensing and perception platform. The objective, he said, is to position Ouster as a tier-one supplier for advanced physical AI systems that demand cohesive, high-performance sensing solutions.

Even with the integration goals in mind, Ouster confirmed that StereoLabs will function as a wholly owned subsidiary rather than being fully merged into Ouster's operational framework.

Despite widespread enthusiasm surrounding physical AI, Pacala clarified that the acquisition was not motivated solely by market excitement or the surge of investment capital into the sector. He expressed a measured perspective, particularly on humanoid robotics, an area that has garnered significant attention in recent years.

Pacala emphasised that Ouster's strategy centres on delivering certified, safe, and practical systems that genuinely solve customer challenges, rather than capitalising on short-term hype. He suggested that the path to market for many humanoid robotics applications may prove longer than anticipated, and that some disillusionment could emerge as expectations confront practical realities.

Others share Pacala's pragmatic stance in the industry. In a separate interview, Glen DeVos, CEO of MicroVision, commented that the sensor sector appears ready for further consolidation. He argued that current revenue levels may not be sufficient to sustain the number of competitors presently operating in the market.

DeVos suggested that the industry is likely to continue consolidating or experience a natural reduction in participants as weaker players exit. This perspective reinforces the broader pattern of mergers and acquisitions reshaping the perception sensor industry as it adapts to evolving technological and market conditions.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0